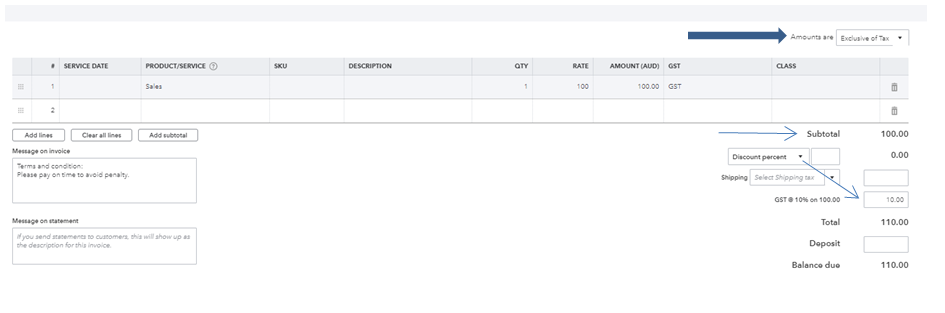

exclusive tax and service charge

Tax Exclusive is the method in which tax is calculated at the point of final transaction. Federal Universal Service Fee USF State Telecom Relay Service Surcharge.

Why Are Bills Always Shown As Tax Exclusive

I can explain this as long as Chris is going to.

. What does it mean exclusive of tax. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. If the VAT rate is 10 the tax inclusive price of an item may be 110 while the tax.

On the other hand the exclusive sales tax is defined as the amount that doesnt include the sales tax. Once you have the value of the product or service and the tax rate for your state calculating a price inclusive tax is quite easy. Since there are restaurants that do not include service charges in their prices and simply adds it in the final bill a customer can be in for a shock of their lives.

McDouble 1 Sm fries 1 Sm drink 1. Imagine being charged with an. Follow the following formula.

Exclusive Charges means the sum of the charges for the Exclusive Station Services as such charges are specified in Schedule 2 subject to such variations as satisfy both the following. This page describes the taxability of. Tax is either 19 or21 for 319 or 321 Same meal different tax.

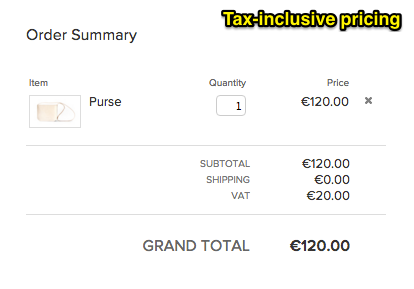

Tax inclusive is the price including VAT whereas tax exclusive is the price expressed without the VAT. Net Price Sales. A merchant may charge.

If a price is inclusiveof postage and packing it includes the charge for this. 1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. Service Charge is only applied to the subtotal.

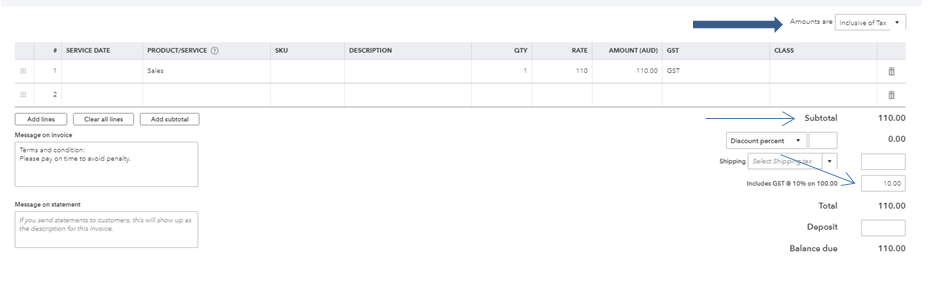

If a service enterprise gives to a vendor a resale certificate for tangible personal property subsequently uses the property in a service transaction or under a service contract. GST Calculator Service Charge Calculator. Here are some but not all of the taxes fees and surcharges you may see on your bill.

Tax exclusive as the name suggests refers to that tax which is exclusive to the value of the good which implies that tax is charged on the total value of the good. The sales tax is charged later by adding up the amount in the already listed price. F.

What is Tax Exclusive. To calculate GST and Service Charge based on subtotal. Here at Exclusive Tax Service we devote our practice to understanding each of our clients caring about their goals and successes and proactively responding to every clients needs.

Service Charge Tax is only applied to the Service Charge.

Collecting Vat Or Gst Squarespace Help Center

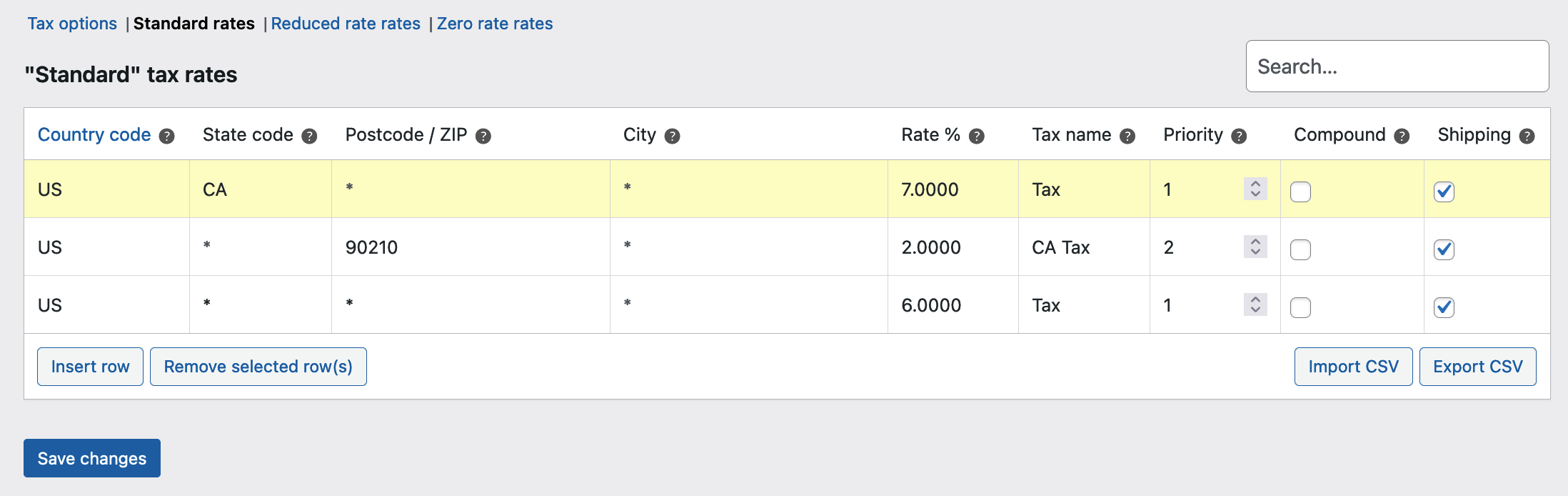

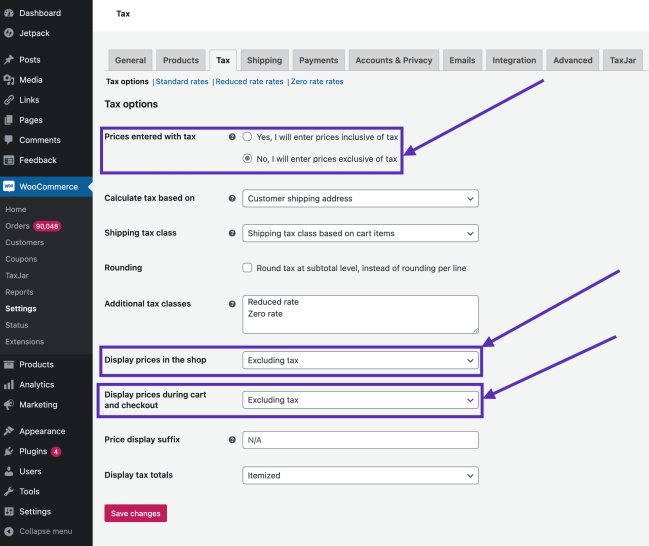

Setting Up Taxes In Woocommerce Woocommerce

Arnaud S Menu In New Orleans Louisiana Usa

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

What Services Are Subject To Sales Tax In Florida

Tax Inclusive Vs Tax Exclusive What S The Difference

Booking Engine Create And Manage Taxes

Setting Up Taxes In Woocommerce Woocommerce

Exclusive Tax Services Home Facebook

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

Brex Credit Card Review Who Qualifies And What Benefits Does It Offer

Solved What Is The Difference Between Tax Exclusive And Tax Inclusive

Exclusive Tax Services Home Facebook

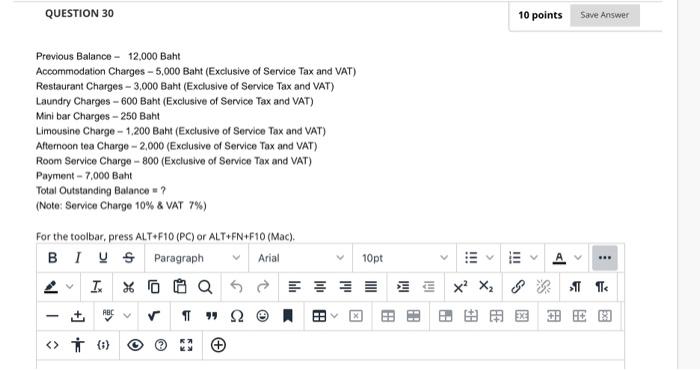

Solved Question 30 10 Points Save Answer Previous Balance Chegg Com

Solved What Is The Difference Between Tax Exclusive And Tax Inclusive

Setting Up Taxes In Woocommerce Woocommerce

Birthday Party At Fairytale Island In Bay Ridge

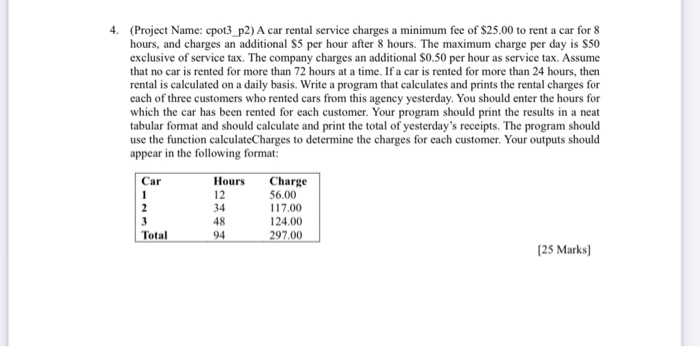

Solved 4 Project Name Cpot3 P2 A Car Rental Service Chegg Com